Overview

The Sewickley Academy Endowment Fund (the “Endowment”) has a current market value of approximately $35 million and consists of over 60 individual funds. Some of these funds are endowed gifts, while the majority of them are donor contributions and surplus funds that have been designated by the Academy as “quasi-endowments.” These various funds that comprise the endowment provide perpetual financial support for financial aid, faculty chairs, instruction, support services, and other important Academy programs and services.

An endowed gift is intended to provide the Academy with a permanent source of funding by directing us to invest the principal amount of the gift and use a portion of the income it generates to support the designated purpose. Quasi-endowments are treated like endowed funds, except that there is no prohibition against spending any portion of a quasi-endowment in accordance with its designated purpose.

The Endowment Committee, a committee of the Board of Trustees, is responsible for the overall management of the Endowment. The committee members, who include both Trustees and non-trustees, meet periodically to review endowment performance, evaluate the investment manager performance, review the asset allocation, and make necessary changes as conditions warrant.

Asset Allocation

The endowment and quasi-endowment funds are collectively invested (the Pool) in a mix of Vanguard funds to best achieve the objectives of the Endowment’s Investment Policy and to meet or exceed the performance expectations set forth therein. The Pool is invested with the goal of preserving the purchasing power of the funds while distributing a meaningful, stable flow of income to the Academy, carefully balancing current and future needs. To achieve this goal, the Pool seeks to achieve a total return (price appreciation plus dividends) that (1) equals or exceeds the spending rate, plus inflation, over a full market cycle and (2) equals or exceeds the average return of a composite benchmark weighted according to the target allocation over a full market cycle. The asset allocations for the pool as of June 30, 2020, are as follows:

| Asset Class | Actual |

|---|---|

| Equity: | |

| Domestic (U.S.) equities | 36.8% |

| International (non-U.S.) equities | 36.5% |

| Fixed Income: | |

| Domestic (U.S.) Investment Grade | 26.7% |

Endowment Spending

The role of the Endowment is to distribute an amount annually to the Academy that fulfills donor intentions and supports the Academy’s general operating budget (the Operating Distribution) and to retire Bonds (see discussion below). The amount of the Operating Distribution is determined annually by the Board, taking into consideration both actual and projected results with respect to each of the following: (i) Endowment returns, gifts, distributions, and market value; (ii) Sewickley Academy operating and capital plans; and (iii) Bond covenants and other financial constraints.

The goal of the Endowment Committee is for the Operating Distribution to be set at an amount each year not to exceed 5% of the average market value of the Endowment, net of Bonds outstanding, for the trailing 12 quarterly periods.

Pursuant to Pennsylvania law, the Academy elected in 2004 to base its spending policy for the endowed portion of the Pool on a “total return” approach that takes into consideration capital appreciation as well as dividend and interest income.

In 1997, the Academy issued $9 million of tax-exempt debt (Bonds) to fund construction and renovation costs associated with the Academy’s last major building and facilities project. During that same timeframe, the Academy also conducted its last major capital campaign. As a result of the outpouring of unrestricted gifts, a decision was made to invest the majority of contributions ($6.4 million) in the Endowment rather than to repay the Bonds. The goal was and remains that the invested gift proceeds and the earnings they generate will exceed the annual debt service costs. These bonds were subsequently refinanced in November 2014. Each year, the Finance and Endowment Committees of the Board analyze whether it is more advantageous to the Academy to leave the Bonds outstanding or to repay them in advance of their scheduled maturity. Due to favorable tax-exempt interest rates, it is anticipated that the Bonds will continue being repaid as scheduled, with a final maturity date in 2022.

As long as these Bonds are outstanding, the Endowment distributes to Sewickley Academy sufficient funds to cover the Endowment’s portion ($6.4 of $9.0 million, or approximately 71%) of debt service and out-of-pocket costs associated with the Bonds.

Endowment Performance

6.54%

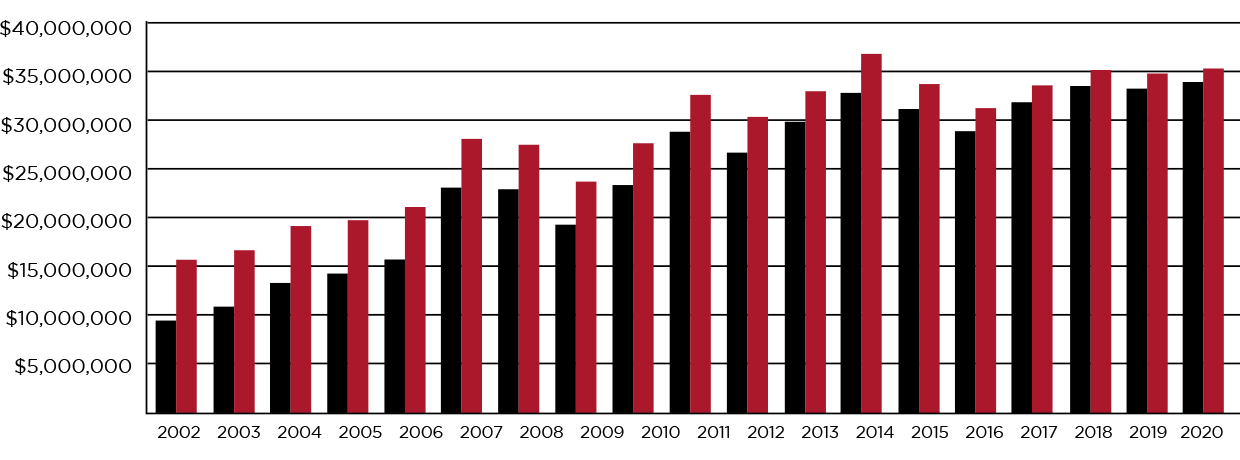

Endowment Growth

Total Endowment Balance

Endowment Balance Net of Debt (Endowment Share)

Endowment Named Funds

The following funds were established by donors for a particular purpose – to support faculty professional development, scholarships and financial aid, speaker series, libraries, or other programming consistent with Sewickley Academy’s Mission.

As of 2005, Sewickley Academy developed a policy requiring that all named funds to the endowment must be established with a minimum threshold of $50,000. The following list represents both endowed named funds prior to 2005, and new funds fully established since the adoption of the policy.

| Name | Actual |

|---|---|

| Barker D. Wardrop Memorial Scholarship | 76,423.32 |

| Richard A. Clark Memorial | 2,564.78 |

| Heinz Scholarship Fund | 99,997.94 |

| Elizabeth Drummond Hull Fund | 7,121.06 |

| Thoms Shields Robinson Memorial Scholarship | 166,219.85 |

| Mary Clause Heard Memorial Scholarship | 170,623.47 |

| MS and FB Nimick Library Fund | 8,385.30 |

| ME and WP Snyder Fund | 87,717.46 |

| John Scott Wendt Jr. Memorial Fund | 43,694.53 |

| William Penn Snyder Jr. Memorial Scholarship | 343,841.34 |

| General / Board Designated | 6,606,581.57 |

| James E. Cavalier Scholarship Fund | 184,708.75 |

| Lucy K. Schoonmaker General Fund | 175,193.33 |

| Don Rose III Memorial Scholarship | 54,632.47 |

| Douglas Bermingham Scholarship | 23,456.07 |

| James Porter Edson Memorial Scholarship | 15,861.47 |

| Senior School Class Fund | 127,031.17 |

| Leading The Way Capital Campaign Phase II | 7,203,534.90 |

| Edward E. Ford Foundation | 279,879.60 |

| Boyd-Edson Memorial | 9,538.08 |

| Gillespie-Engstrom Library Fund | 26,198.55 |

| Patricia Schoetz Music Fund | 21,417.75 |

| Milton M. Fenner IV Memorial | 9,432.68 |

| Neal Mitchell Fund | 50,289.23 |

| Taylor Science Prize | 2,318.40 |

| Lawson Family Scholarship Fund | 48,966.40 |

| Charles T. Koval Scholarship Fund | 147,006.19 |

| Stanwood Partenheimer Memorial Scholarship | 12,269.20 |

| Galbraith Fund | 7,241.66 |

| E. Thorne McKallip Scholarship Fund | 619,690.92 |

| Elizabeth Bishop Martin Fund | 17,491.18 |

| Deborah Thaw Valera Scholarship | 19,189.77 |

| Harry E. Klos Memorial | 306,364.63 |

| Name | Actual |

|---|---|

| Tuck McClintock Community Service Award | 12,741.87 |

| Arthur L. & Ann Coburn Memorial Student Support Services Fund | 15,164.32 |

| Faculty Memorial Endowment | 9,145.35 |

| Faculty Fund for Financial Aid | 72,811.17 |

| Picture This – Financial Aid | 1,689,562.61 |

| Picture This – Eden Hall Fund | 83,572.11 |

| Picture This – Endowed Chairs | 3,406,368.23 |

| Picture This – Global Education | 2,620,665.46 |

| Picture This – Faculty Professional Development | 2,416,296.21 |

| Picture This – Student Support | 674,134.44 |

| Picture This – Designated | 28,127.09 |

| Lucy K. Schoonmaker Aunt Lute Fund | 165,905.63 |

| Susan Shelton Houghtaling Scholarship Fund | 49,142.20 |

| Claudia Gallant Global Studies Fund | 9,912.14 |

| Albert & Bertha Sector Speakers Fund | 72,596.46 |

| Sculley Sabbatical | 127,539.91 |

| Clark Faculty Chair | 331,472.14 |

| Henriette Rougraff Memorial Fund | 678,385.99 |

| Clifford Nichols Jr. Faculty Fund | 113,646.41 |

| Edward E. Ford Foundation | 212,342.39 |

| Patricia S. Rose Professional Development Fund for Teachers of English | 55,942.24 |

| Wm. Gregg Hansen Memorial Scholarship Fund | 396,554.55 |

| Capital Campaign – Picture This | 49,203.65 |

| Picture This – McAdams Scholarship Fund | 864,901.73 |

| Picture This – Faculty Professional Development | 232,819.78 |

| Picture This – Alumni Scholarship Fund | 28,850.23 |

| Picture This – Geller Family Educational Speakers Fund | 97,213.60 |

| Picture This – Global Education & Tech Fund | 22,591.39 |

| Picture This – Endowed Chairs | 1,270,389.50 |

| Picture This – Geller Family CATCH Fund | 115,105.17 |

| Breakthrough Pittsburgh | 550,060.22 |